The Farmers Club is now Sun Tzu Academy 🧮! This is our inaugural issue of In the Loop where we'll try our best to cover all things DeFi weekly - the news, fresh protocol launches, yield farming opportunities, the coins we're digging, and threads that are just too good not to share. I’m rektGEMS, and I’ve teamed up with my frens Winter and Crypto Andrew to bring you a variety of perspectives! Stay tuned for more content curated by the three of us. We appreciate your journeying with us in this new endeavor.

NEWS

Weekly News Recap by rektGEMS:

The CRV situation continues to develop, here is a quick recap of what happened.

Over $42M worth of CRV have been OTC’d so far.

You can track all the OTC wallets here: https://app.cielo.finance/feed/preview/4099-$CRV-OTC-%F0%9F%92%B0

Stolen fund has been returned to Alchemix, alETH/ETH back to ~0.95.

Y2K Finance embraced the storm and launched a “Touch” vault for CRV.

Mantle leads the 7D TVL growth, TVL has gone up 788% last week.

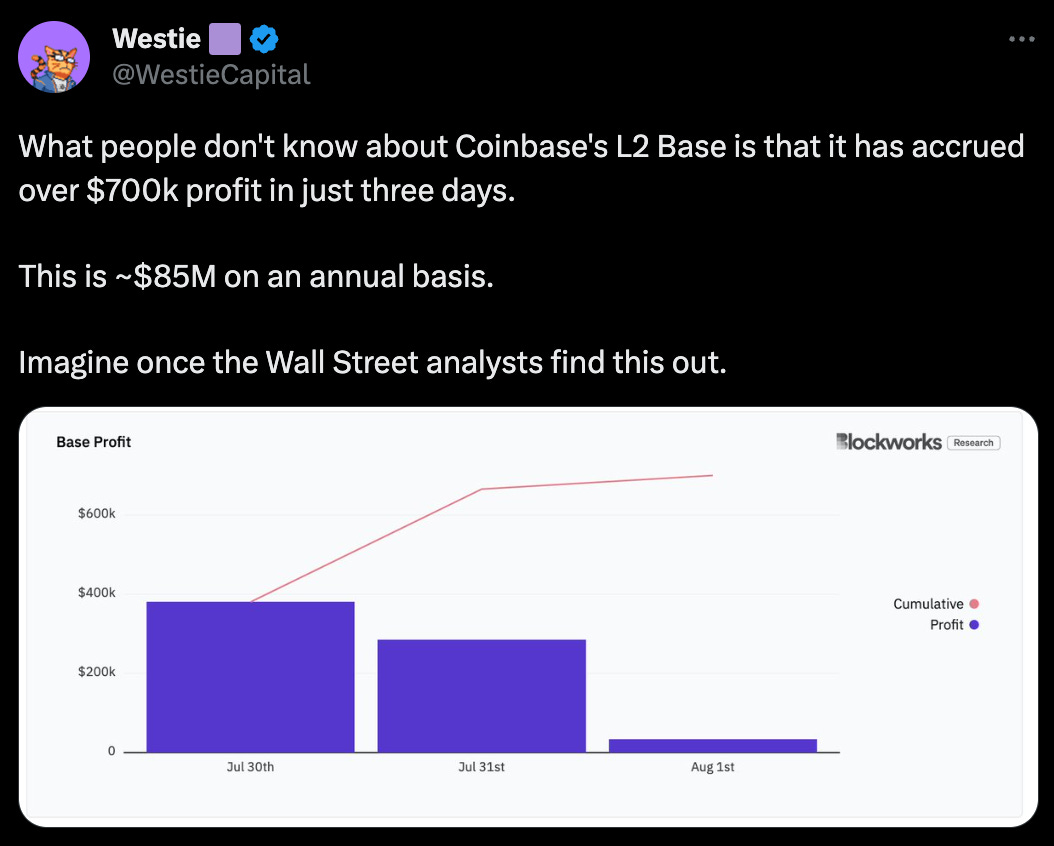

Thanks to Milkyway kek, BASE chain earned $700K in profits in just three days.

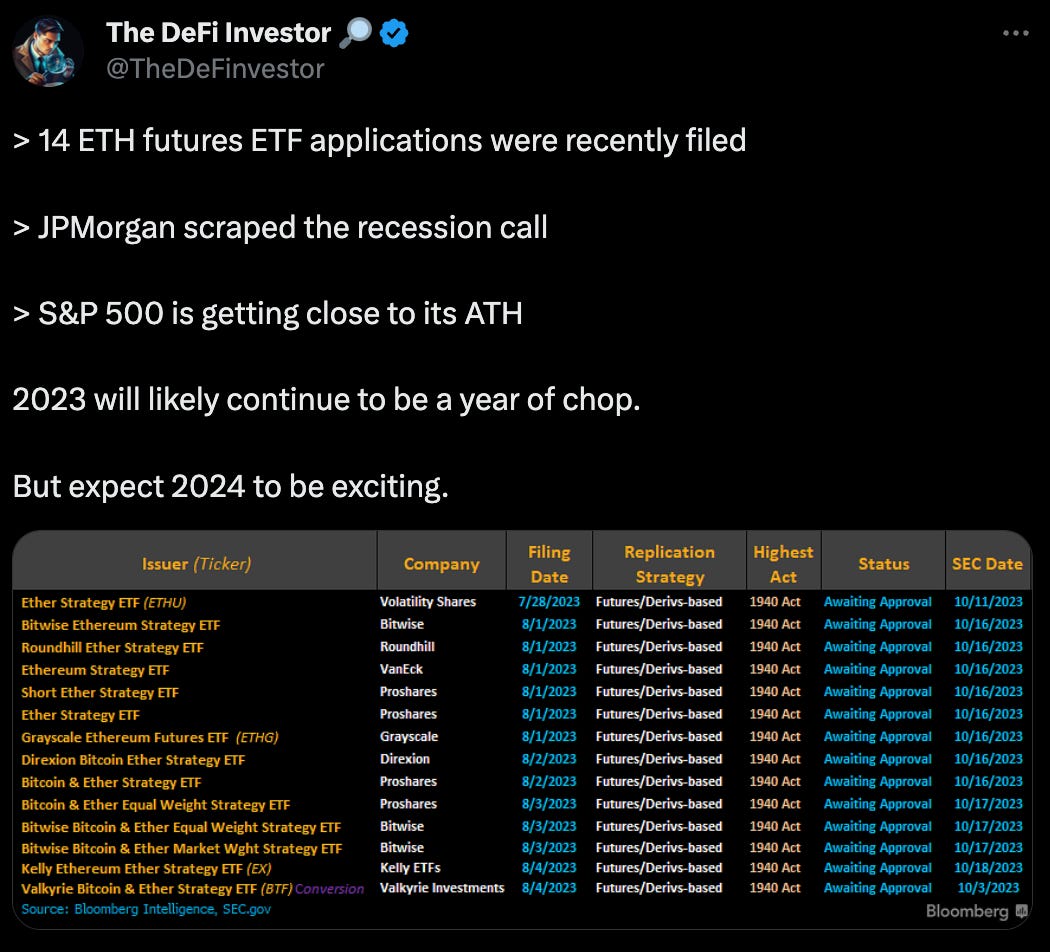

14 Ethereum futures ETF applications have been filed last week.

EDSR is now live.

The highly anticipated GMX v2 now live on Arbitrum and AVAX mainnet.

Great rundown on v2 features by @1chioku.

And a TL;DR by @0xwenmoon

Forex pairs might come to Curve soon.

ve(3,3) exchange on BASE announced tokenomics and distribution details. 40% of the initial supply will be airdropped to veVELO holders in the form of locked AERO. Snapshot not taken yet.

Trader Joe had a busy week, deployed stablecoin pools on Ethereum mainnet and launched on-chain limited order.

One of the OG Perp DEX CAP Finance deployed on BASE chain. Looks like to be the first Perp DEX deployed there.

Restake Finance, a modular liquid restaking protocol powered by EigenLayer launched beta.

Some GambleFi news for you degens.

COCO Bets announced they will include tax revenue with the weekly revenue share. So far COCO tax wallet has accumulated over $700K in tax revenue.

BetSwirl launched v2 staking pools.

House Money, a new GambleFi project launched its sportsbook Telegram bot.

NFTfi sector has seen some strong growth this year despite NFT floor price has been down only.

NFTfi project Protectorate released a V1 update. Their flagship product: NFT Capsule is launching soon.

Weekly News Recap by Winter:

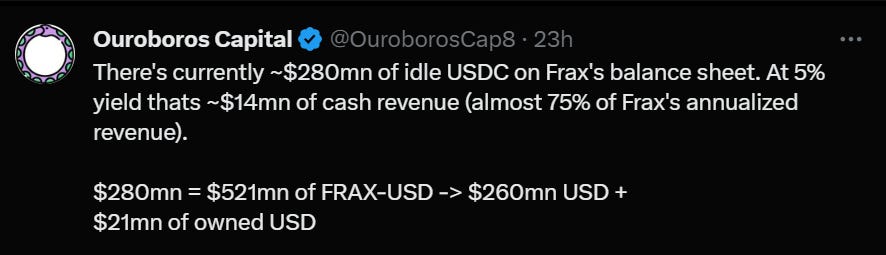

RWA coming onto FRAX

- Like Makerdao, Frax Finance has already identified regional to hold parts of its ideal cash offchain in Tbills and similar cash deposits

- Pivotal timing as FXS experienced max FUD event during CRV explot/liquidation saga

Offchain Labs announced first step towards decentralization

Binance covered recent trends in bot meta

- Visible TWAP from big whale on $UNIBOT

- Imminent Binance listing or just another speculation?

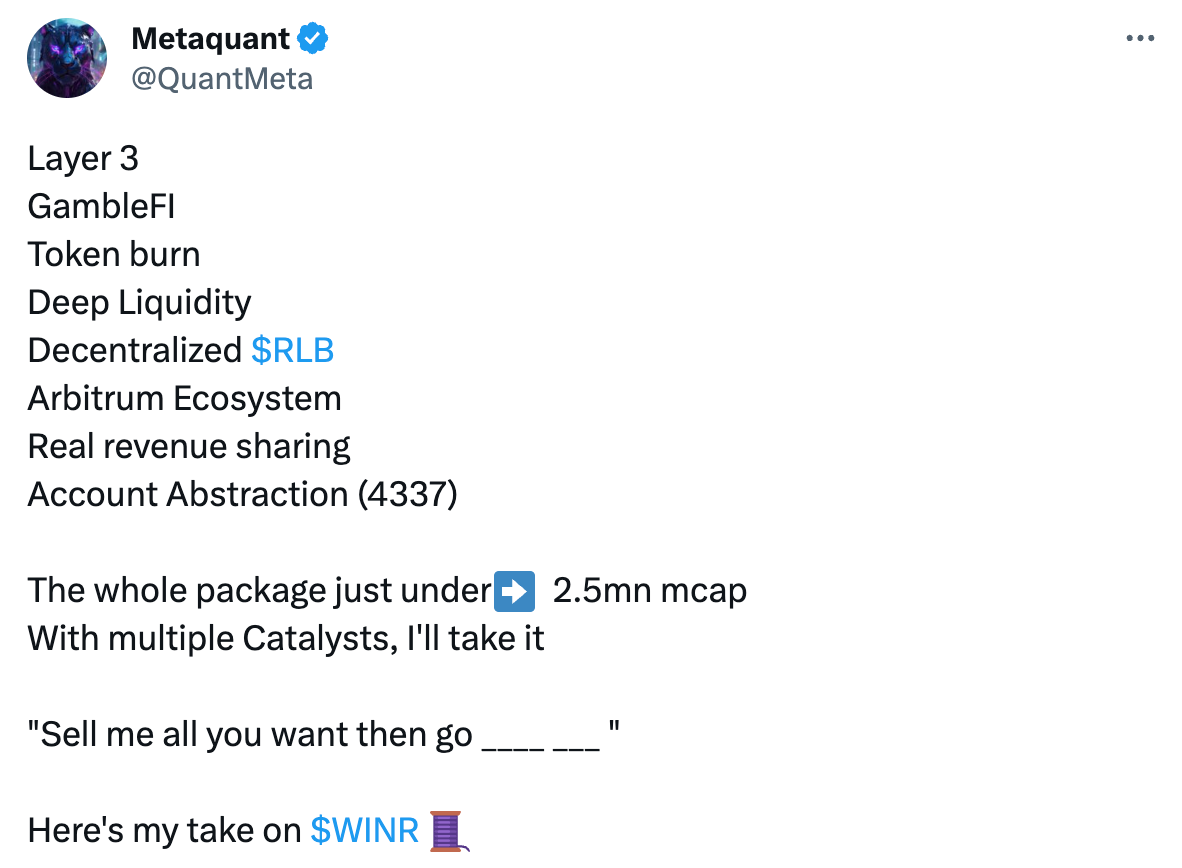

WINR introduced Degensbet (ETA Q3 2023), bread and butter of Rollbit

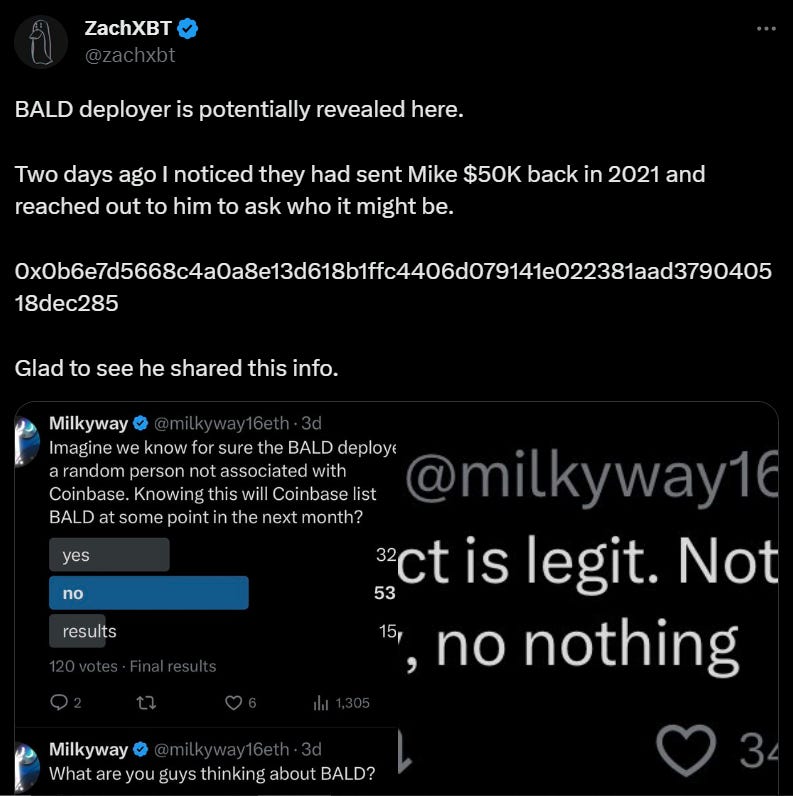

BALD rug with its silver lining?

- BALD deployer made 2.8k ETH or 5.2m USD on first pull, revealed to be milkyway.eth

- Just another >5m liquid got sucked out from on-chain in this draught.

- Lucky or not, it was not someone affiliated to Coinbase / Brian Armstrong that pulled this heist

Weekly News Recap by Crypto Andrew:

LSDfi leader Lybra and their upcoming V2 and potential Lybra wars, details in the article below 👀⬇️

Another new L2 - Mantle and everything that you need to know about its progress.

IT AIN’T MUCH BUT HONEST WORK

What rektGEMS Has Been Farming:

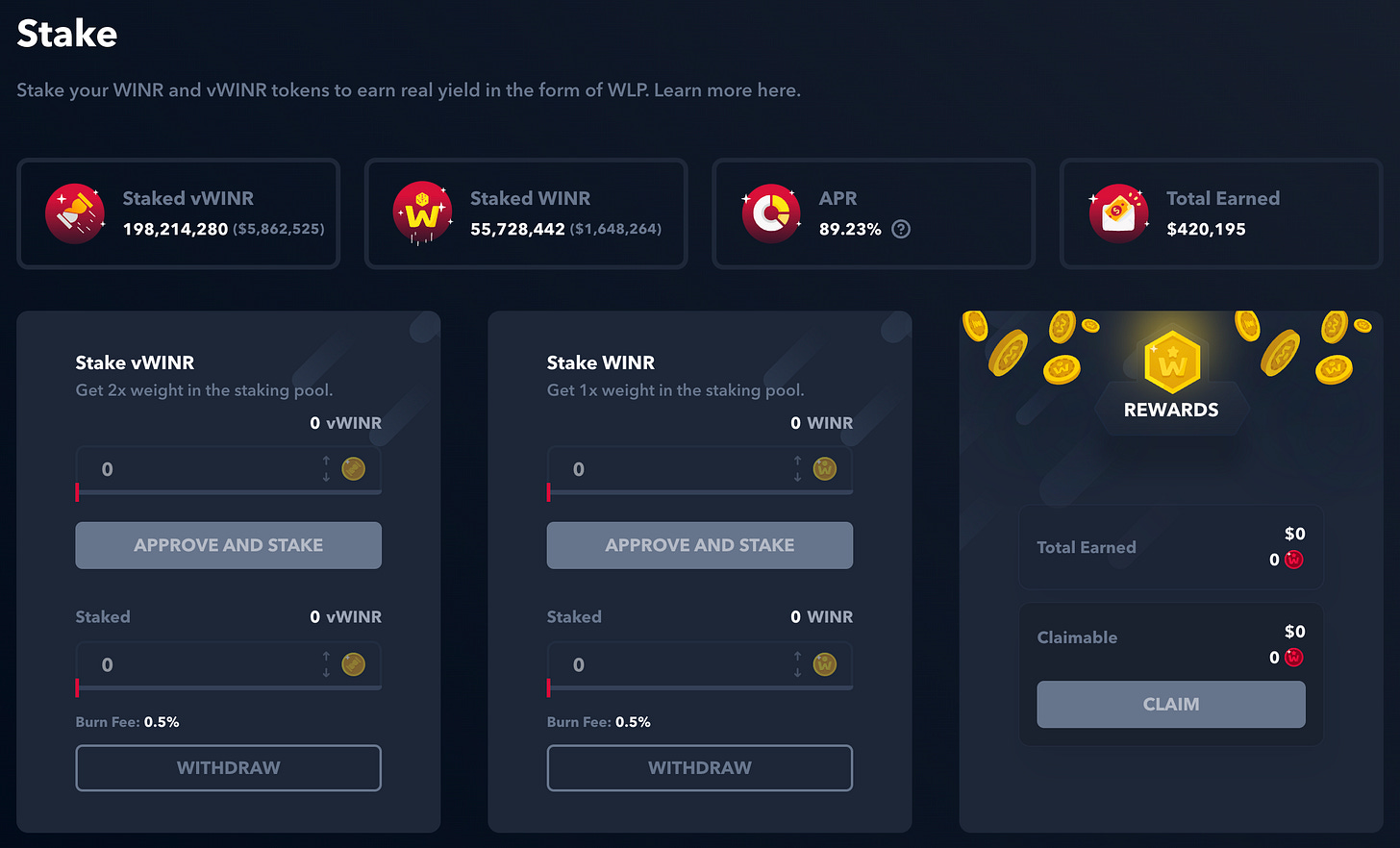

Current APR:

WLP - 261% paid in WLP and vWINR

WINR - 45% paid in WLP

vWINR - 89% paid in WLP

WINR recently has gained a lot of attention thanks to the GambleFi narrative. Although a lot of bullish catalysts in the horizon, I believe we will have plenty of time to accumulate WINR. For that reason I chose to farm WINR with buying WLP instead. WLP is very similar to GMX’s GLP, it’s a basket of three assets: 76% in USDC, 18.8% in ETH and 5.2% in BTC. 100% users PnL goes to WLP as well. WLP price has gone up 5.7% since May. The yield is paid in WLP and vWINR, which is vesting WINR. You have the option to unlock your vWINR in 15 days by taking a 50% haircut.

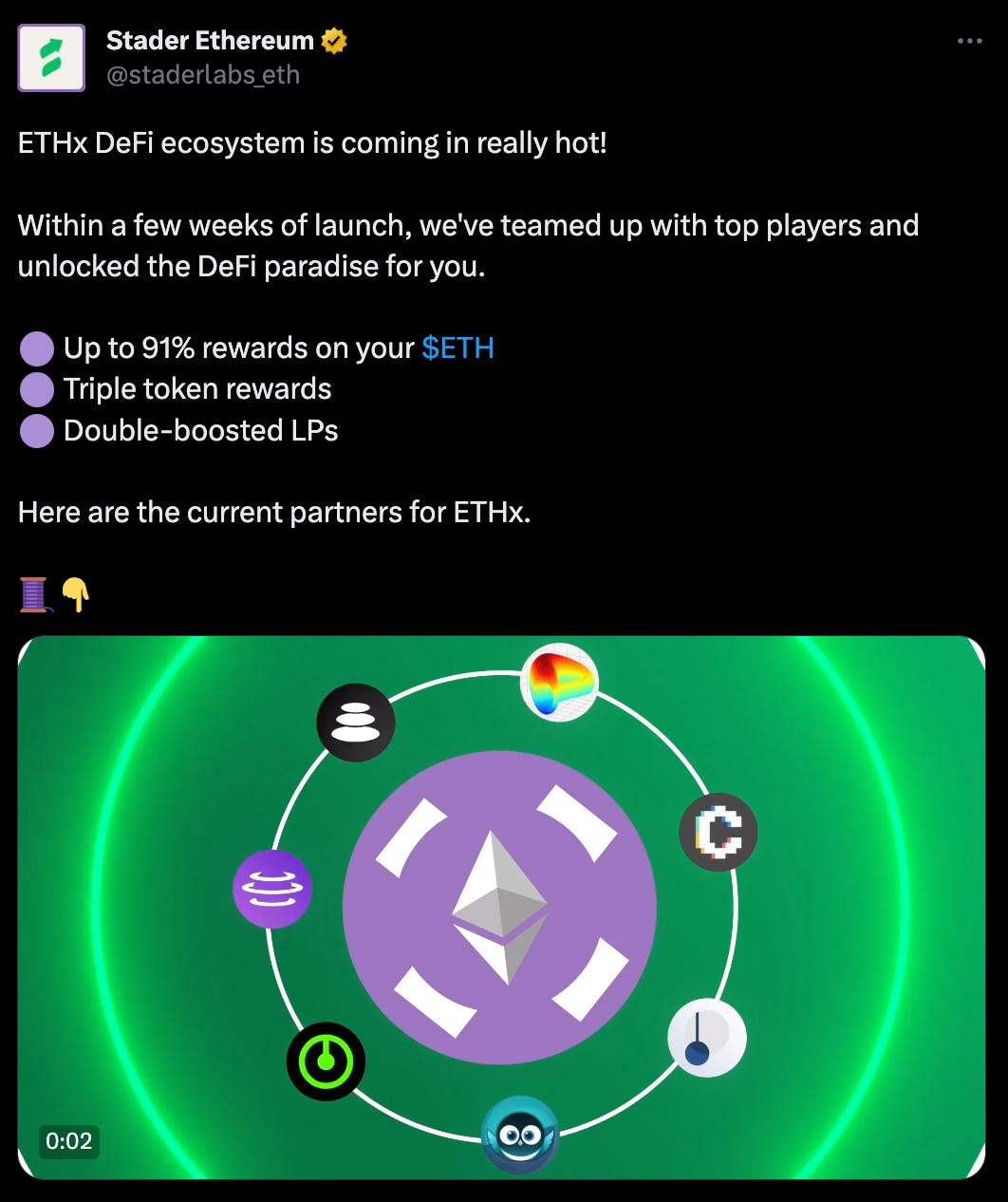

Probably the best ETH yield right now? I did a deep dive on Stader last year before it went 7-8x, they recently launched their ETH liquid staking token: ETHx, and they are boosting the yield on various protocols, here are some highlights:

Incentivized Balancer pools launched on Avalanche. I’m not farming there yet, but 23% APR on USDC-EUROC, 15% APR on USDC-USDT, Up to 27% on AVAX LSDs seem like great safe yield.

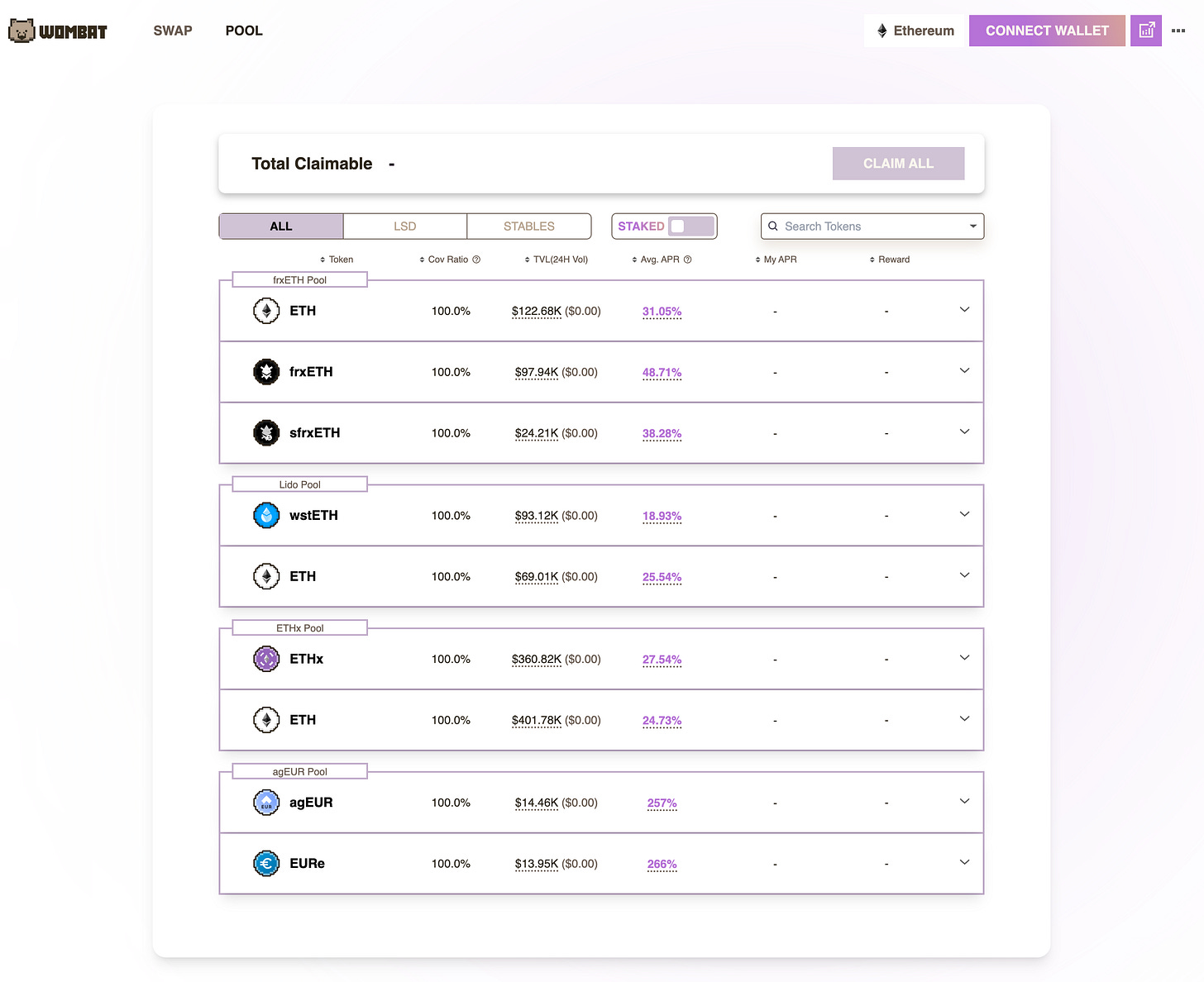

ETH LSTs and Euro Stablecoins on Wombat

Wombat launched on mainnet and has gone unnoticed. 49% APR on frxETH and 250%+ APR on Euro stablecoins are pretty juicy. However, TVL is pretty low so yield will be diluted once more whales enter this farm.

DEXSCREENER WATCHLIST

Chart rektGEMS Has Been Watching:

Smart Money Net Swaps by ChainEDGE

Sorted by 7D net change

I understand LSDFi narrative is really weak right now but BTRFLY has multiple catalysts on the way(you can find the most recent update here) and its price is back in the lower range.

- pxETH imminent

- Dinero stablecoin soon

- Hidden Hand going multi-chain

FXS has gone back up to its pre Curve exploit level. With the recent announcement of RWA backing and FRAX v3 coming soon, I will certainly watch this chart closely.

Chart Winter Has Been Watching:

- Fresh perp dex with stocks and forex @1000x(only forex)

- GLP as liquidity -> easy to attract deeper liquidity

- Ongoing HLP farming likely to spark “adoption”

- Expect PA like Vela but better due to less bagholder as presalers are only up around 100% not 10x

- Gamified dex with launchpad, >10m liquidity locked

- Revealed Spartan as launchpad presale allocation

- First launched project was GSWIFT, backed by Bybit which saw ~9x return

- Upcoming project is Parallax Finance, LST project

- Expect PA like GSWIFT, where everyone is playing catchup

Chart Crypto Andrew Has Been Watching:

WINR

- launch of 200-1000x leverage for BTC/ETH + own chain

- Low MC (around 3M)

- Increasing shilling and attention

- Strong PA (bet on strength)

DMT

- launch of own gamblefi chain

- expansion to Mainnet

- strong momentum (PA- and attention-wise)

- more new games

COCO

- turned on revenue share

- more new games

- good shilling and attention

- PA lagging a bit, but is compared with DMT (3x+ higher MC than COCO)

JOE

- watch volume/fees on mainnet

- might catch a bid if metrics improve after the mainnet expansion

THE

- launch of perps

- improved metrics might push the price up

MAV

- first products build on top of it have launched

- strong metrics and high efficiency

THREADS/PODCASTS/INTERVIEWS

Recommendations from rektGEMS:

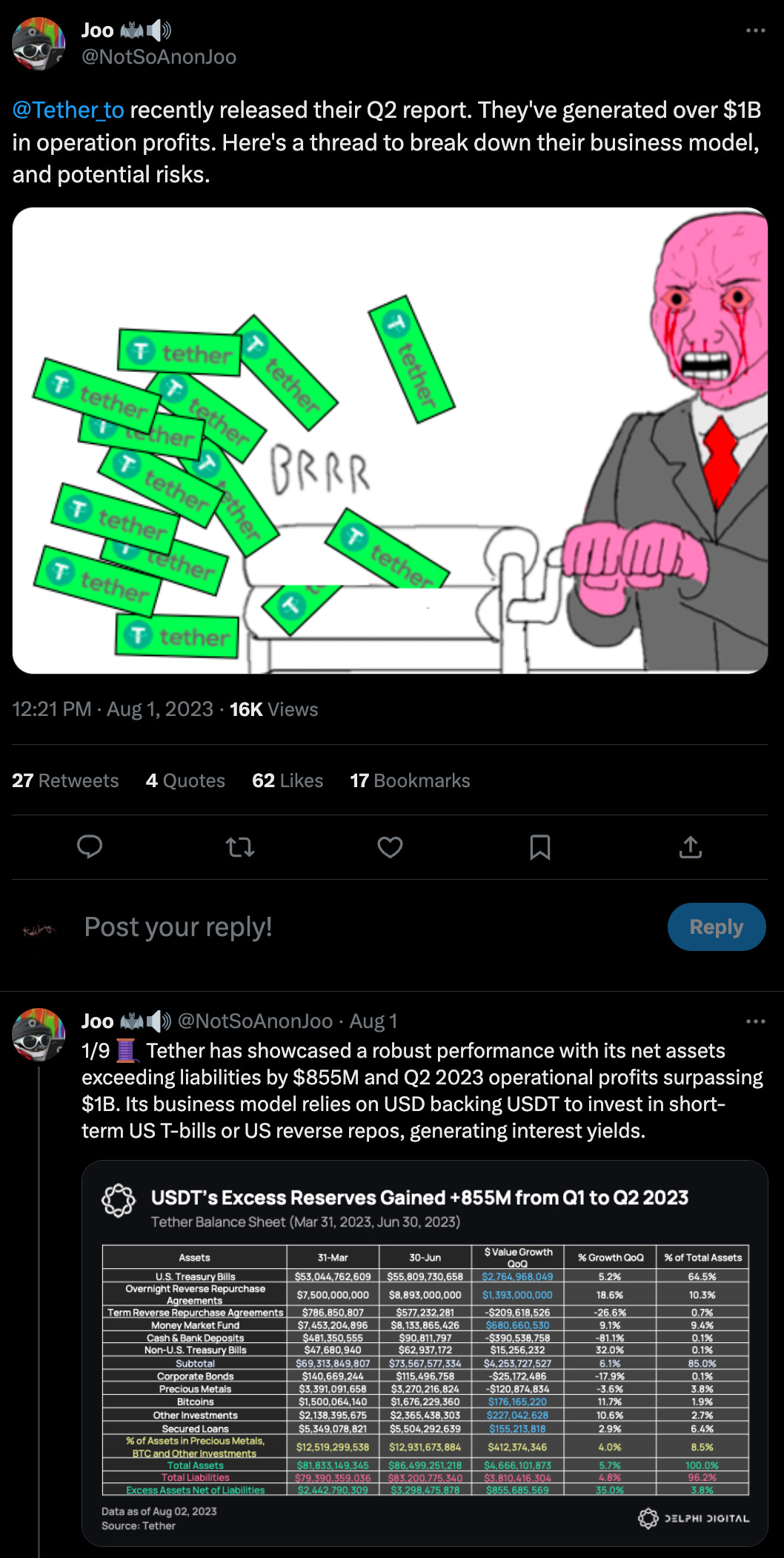

Great thread by @notsoanonjoo on how Tether earned $1B in Q2 2023 by utilizing US T-bills. We already start seeing more and more projects allocating part of their treasury to T-bills and other real world assets. Bullish for RWA.

Great article by our gud fren @Ace_da_Book, explaining why you should considering locking THE. Tons of Thena alfa in this one, highly recommended!

I went back to listen to this pod by Pear Protocol ft. @blknoiz06, really like this quote: get use to taking profit, get use to unpluging… because it won’t mess you up when stuff goes up, but it will mess you up when stuff stops going up.

Recommendations from Winter:

Thread by rektdiomedes on interesting videos during ETHcc

The Narrative Wedge

- Short study into previous major narratives and relevant VC

- Good reference on current running narratives like bot meta, EIP 4844 & RWA

Recommendations from Crypto Andrew:

Given that I am very bullish on GambleFi atm, this is a good article about $COCO ⬇️

Btw, expect an article about this narrative from me tomorrow 😉

Another excellent and short thread about $WINR ⬇️

Not a thread, but a good cheat sheet for Linea eco. I think it will have its time given its backing and funding, definitely worth watching ⬇️