In the Loop Issue 1

Curve exploit, $OP outperforming, $BALD on BASE, airdrop farmings and coins on our watchlist

The Farmers Club is now Sun Tzu Academy! This is our inaugural issue of In the Loop where we'll try our best to cover all things DeFi weekly - the news, fresh protocol launches, yield farming opportunities, the coins we're digging, and threads that are just too good not to share. I’m rektGEMS, and I’ve teamed up with my frens Winter and Crypto Andrew to bring you a variety of perspectives! Stay tuned for more content curated by the three of us. We appreciate your journeying with us in this new endeavor.

NEWS

Weekly News Recap by rektGEMS:

Major Curve Finance exploit due to a bug found in Vyper.

You can find everything happened so far in my thread above ☝️ For the time being I have converted all my stables to USDC/USDT.

Giga brains @_FabianHD and @OuroborosCap8 weighing in on the Curve exploit.

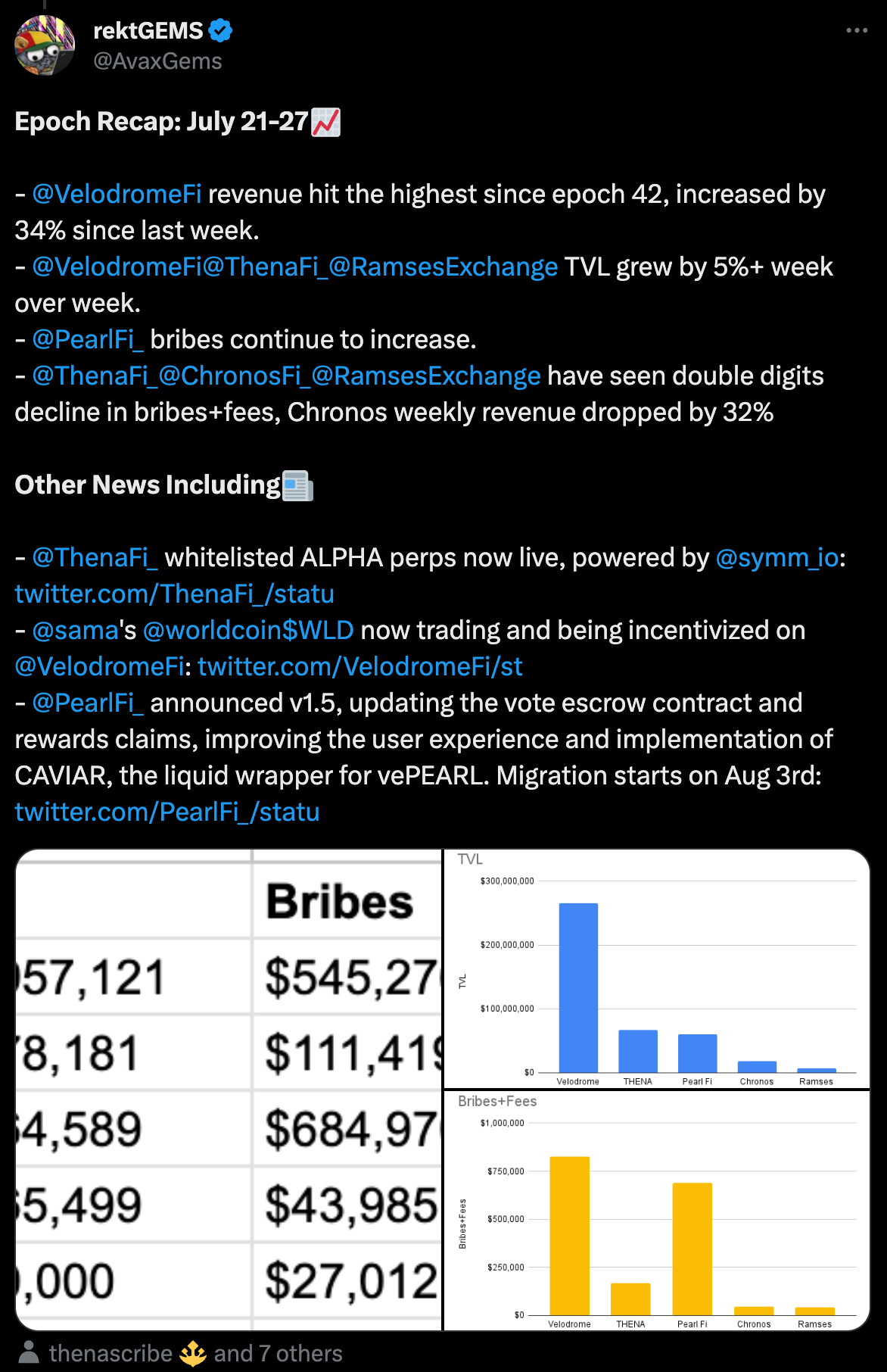

My weekly recap on the leading Solidly DEXes.

Velodrome leading the pack, THENA and Pearl saw steady growth, on the other hand Chronos and Ramses are slowly bleeding.

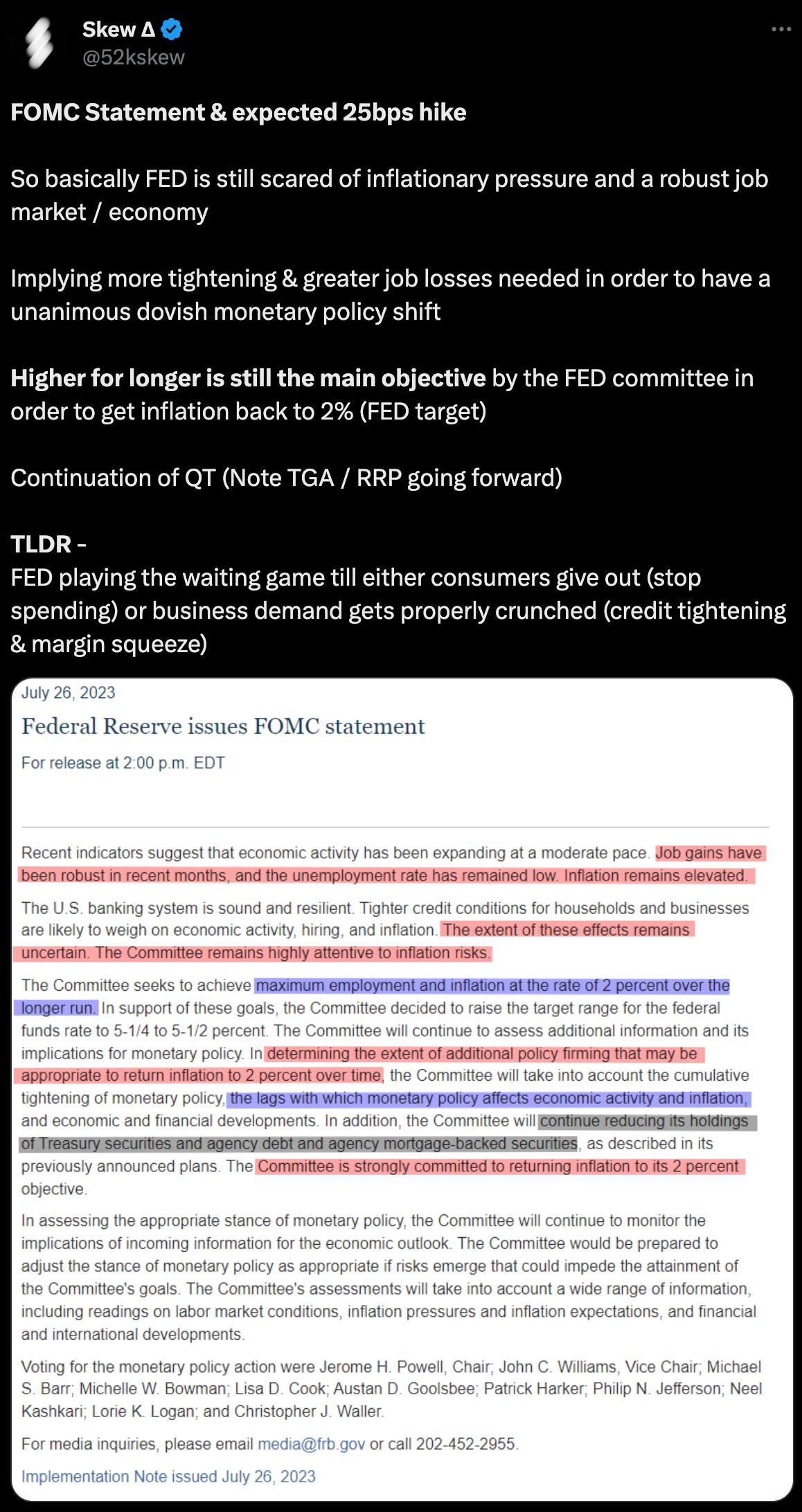

As anticipated, FED raises another 25bps. Higher for longer being played out.

Optimism Foundation introduces the Law of Chains. Optimism Superchains will be governed by OP token, meaning Superchains will want and need OP to protect their interests.

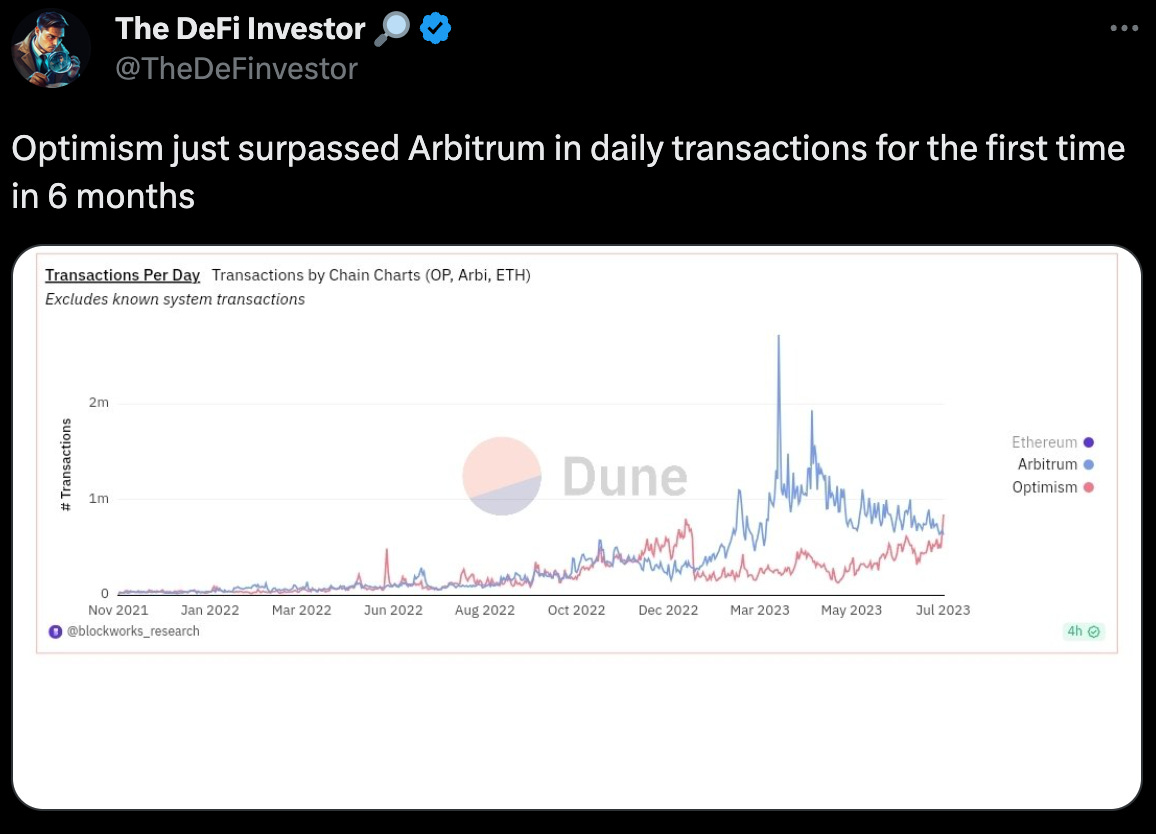

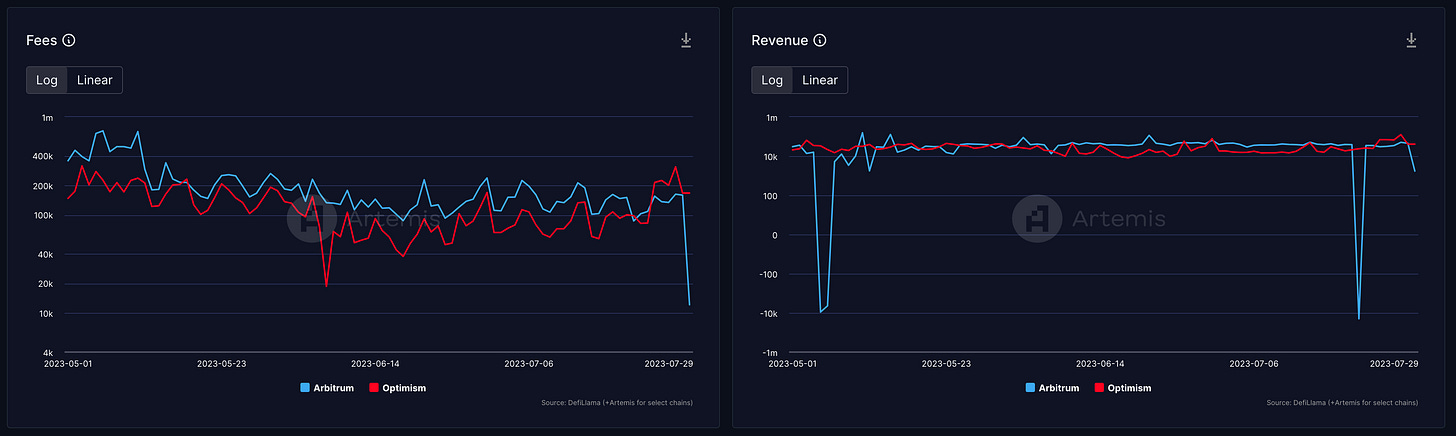

Beyond daily transactions, Optimism now surpasses Arbitrum in terms of gas fees and revenue, as reported by Artemis. Despite this, Arbitrum maintains its lead in daily active addresses, TVL, and DEX volume.

Options protocol Lyra announced Lyra V2 roadmap.

THENA’s Perp DEX now available for alpha test. This might be a catalyst for potential fee growth.

Perpetual DEX UniDex launched on Arbitrum, it offers aggregated orders and 18 different collateral options.

Matrixdock, issuer of tokenized Treasury Bills, has integrated Chainlink's Proof of Reserve. Their stablecoin, sTBT, has notably surpassed a market cap of $100,000,000.

Ethena, a decentralized stablecoin protocol backed by Arthur Hayes, has officially announced a strategic partnership with Synthetix.

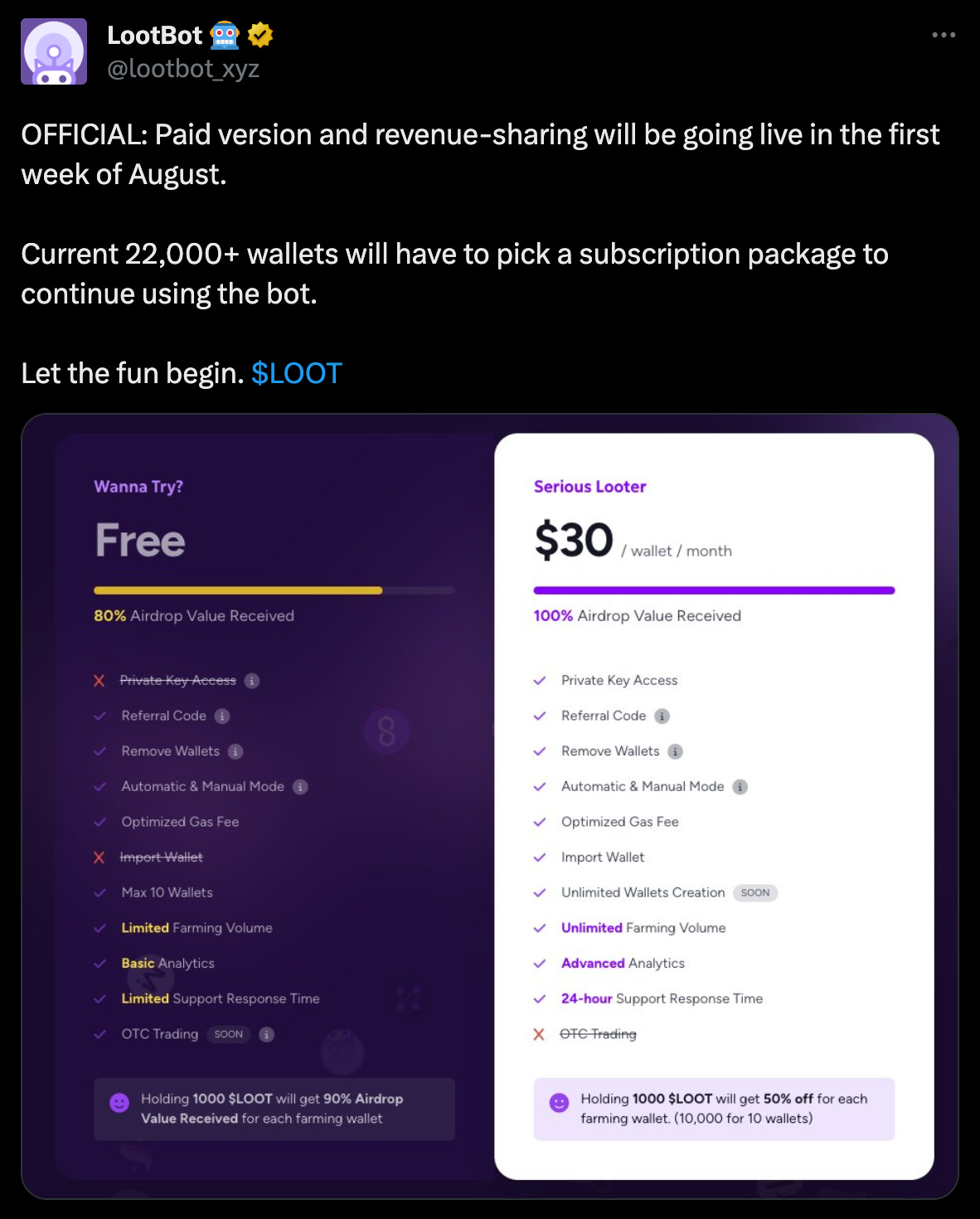

Airdrop farming tool LootBot announced subscription and revenue share model.

Weekly News Recap by Winter:

Spartadex surpasses $10m in lockdrop, reminisce of grail or nightmare of merlin?

-30th Jul is end of phase 1 lockdrop and $SPARTA will be dropped for lockdropp-ers and NFT holders(snapshot taken)

-Phase 2 starts immediately after to lock liquidity of $SPARTA-USDC

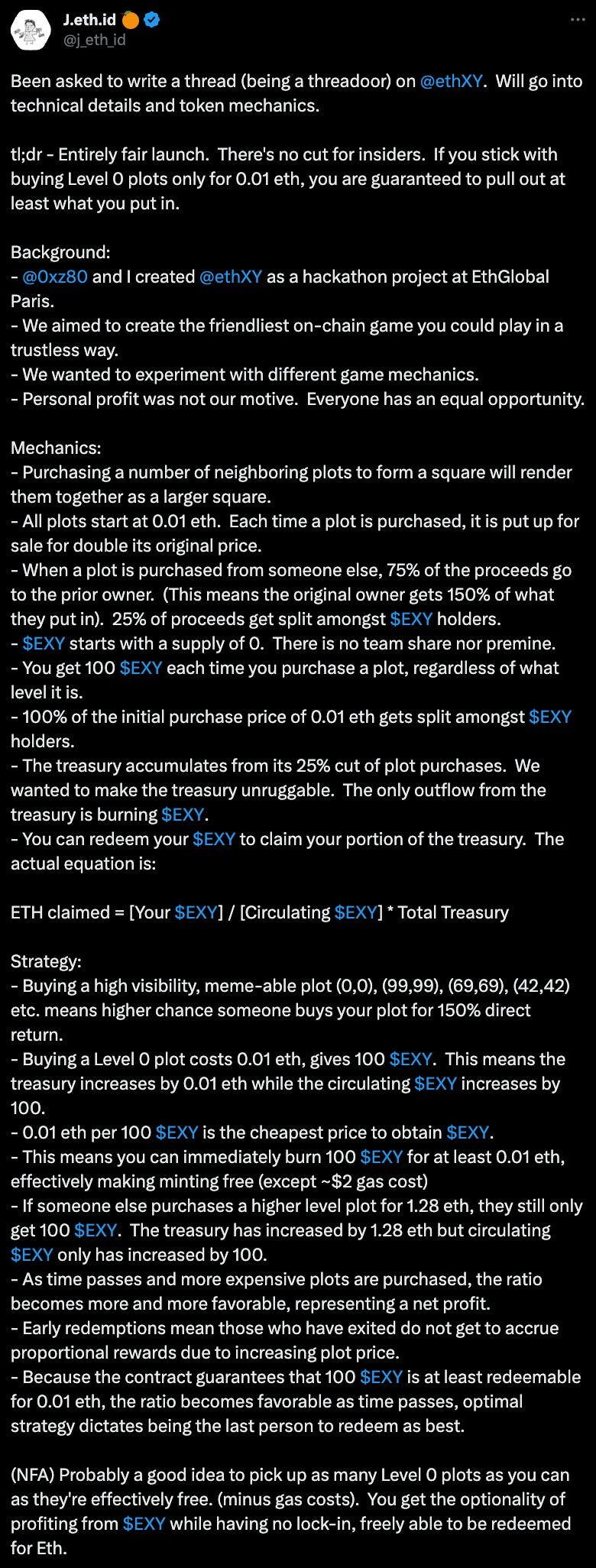

EthXY, ultimate flywheel that unites both NFT bros and ponzi degens.

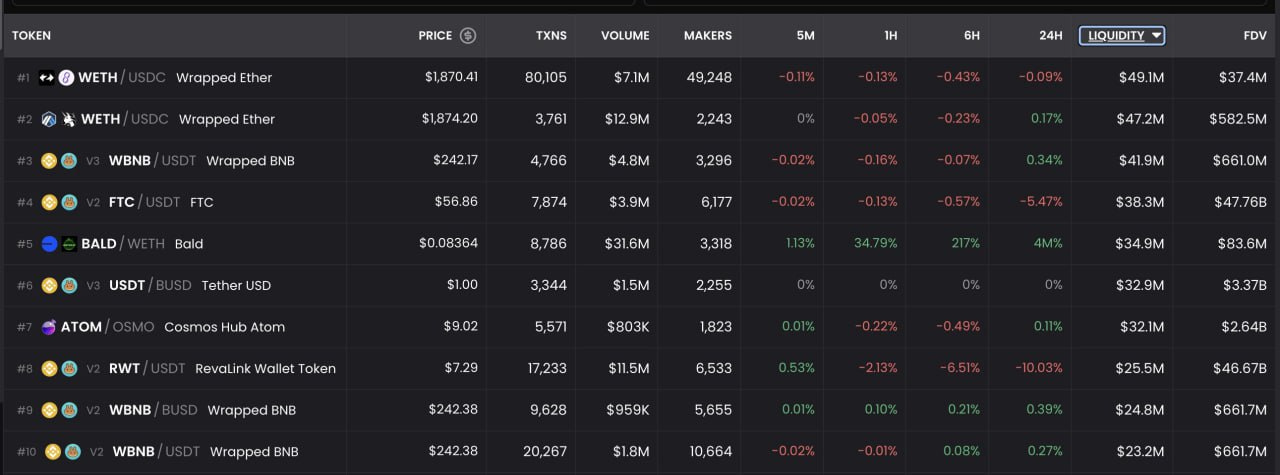

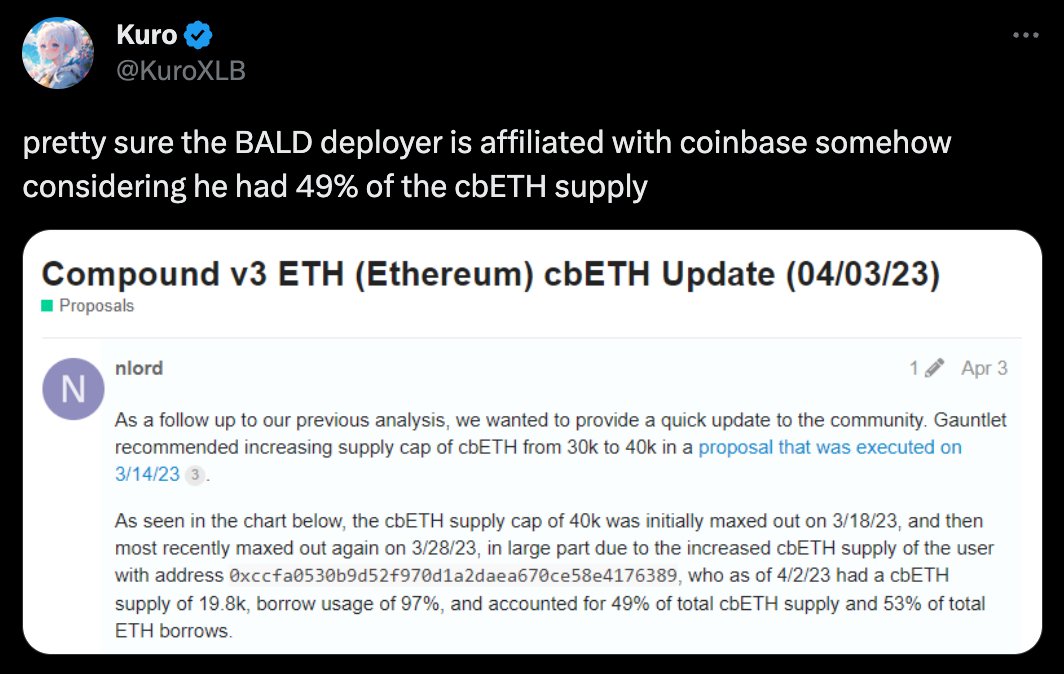

BALD, ticket to homebase or Gensler scoring his ace?

-BALD deployer highly affiliated to Coinbase due to cbETH connection

- 5th liquid pair tracked on Dexscreener on all chains

IT AIN’T MUCH BUT HONEST WORK

What rektGEMS Has Been Farming:

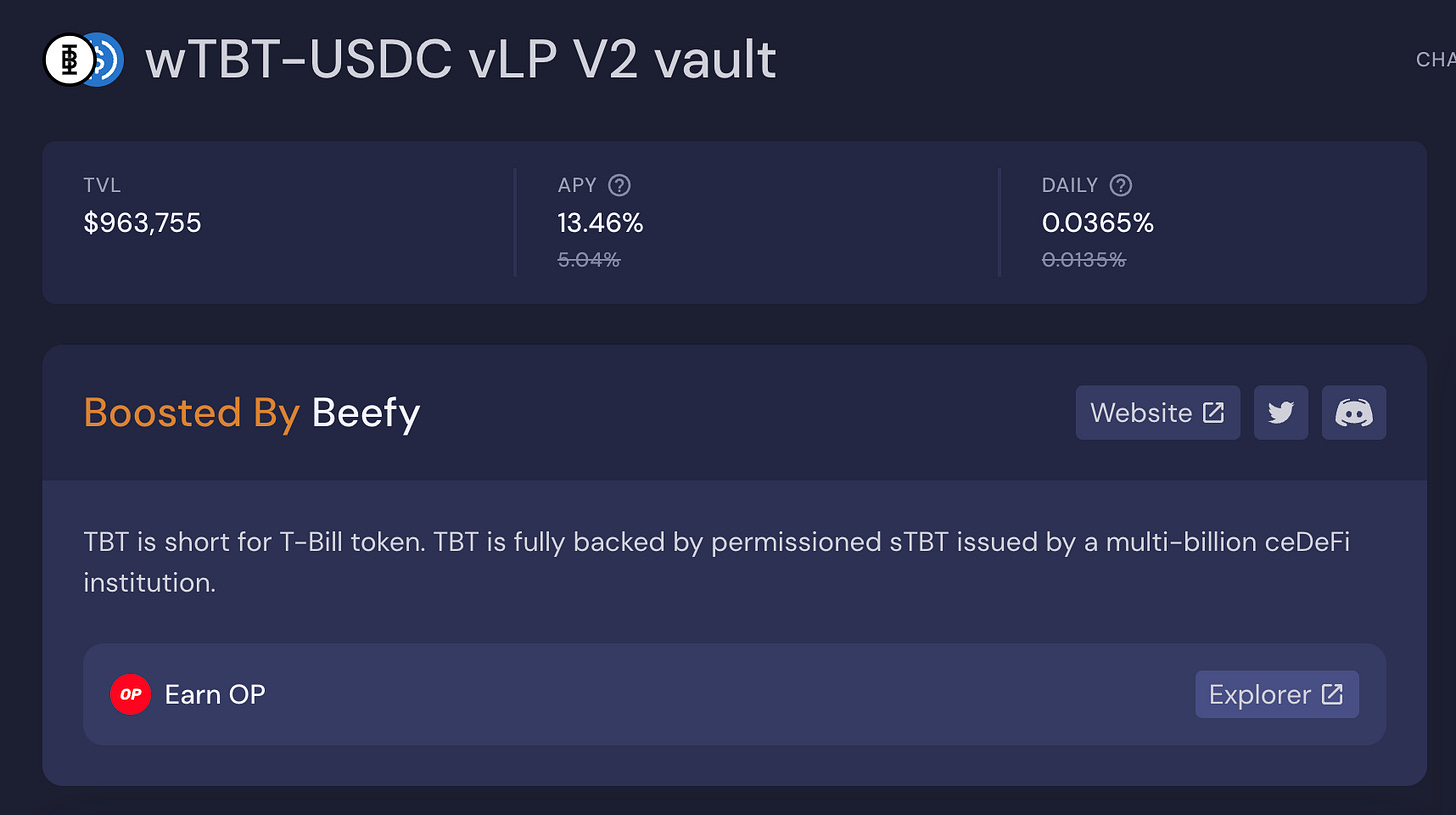

TProtocol has partnered with Beefy to introduce a boosted wTBT-USDC vault. 13.5% APY is decent for stablecoin yield, what makes it more interesting is that 1. wTBT yields 5% APY thanks to the underlying T-bill token. 2. Users who provide liquidity for wTBT-USDC on Velodrome become eligible for future TProtocol token airdrops.

The Worldcoin token, WLD, officially launched on both the mainnet and Optimism earlier this week, and I took advantage of the trading vol by LP USDC-WLD on Uniswap V3 on Optimism. Data from the Revert dashboard shows substantial earnings, with users achieving 1,000-2,000% APR even after fees and impermanent loss. I also use Revert to monitor, auto compound and rebalance my position to maximize my yield.

Please be aware of the risks associated. Over time, USDC-WLD trading volume will decline, reducing yield to a level that may not justify the risk of impermanent loss.

What Winter Has Been Farming:

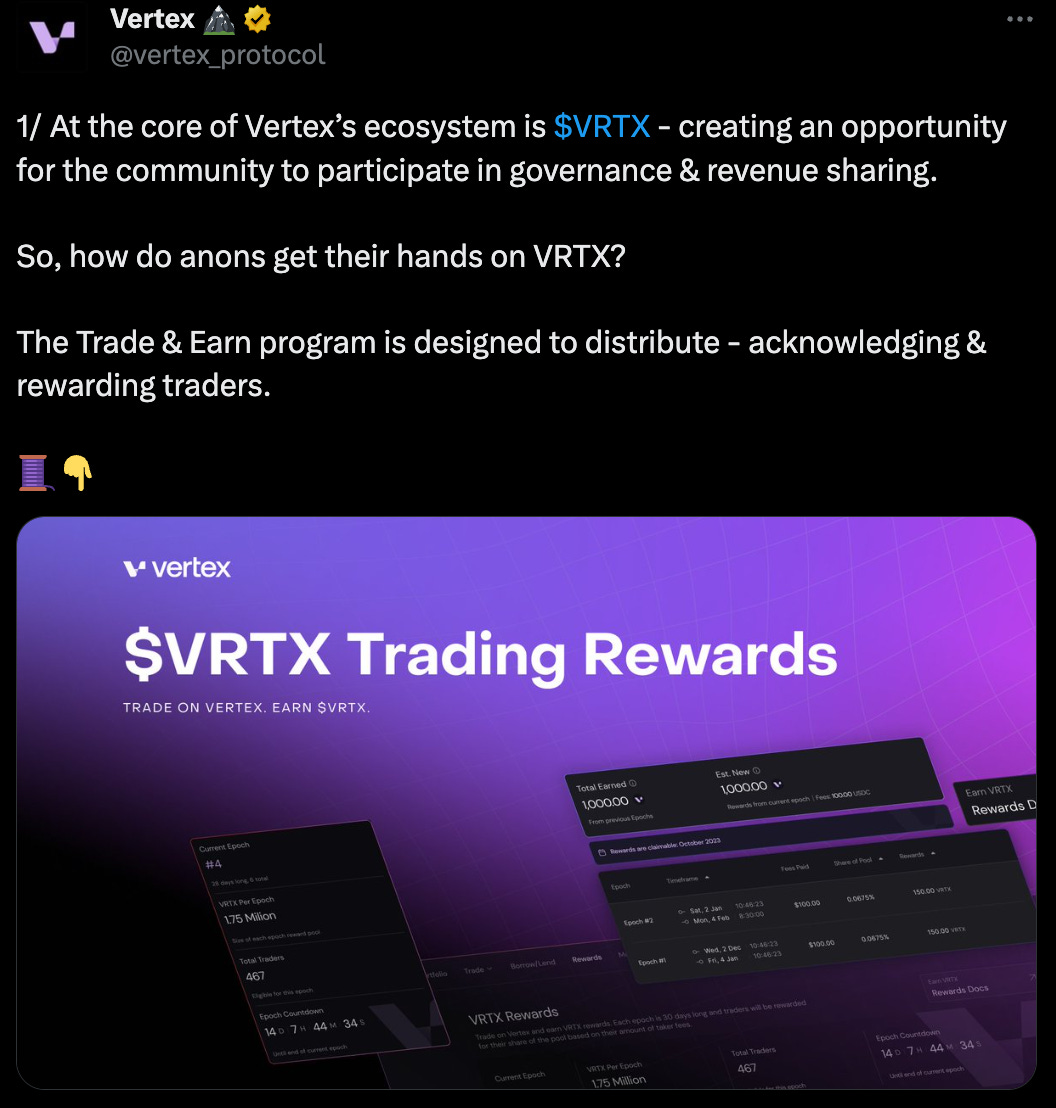

TLDR: CLOB Perp DEX on Arbitrum, gasless confirmation and instant execution.

Raised $8M from VCs and partnering with Elixir and Wintermute. TGE in Oct 23, can be used as hedge for spot holdings.

DEXSCREENER WATCHLIST

Chart rektGEMS Has Been Watching:

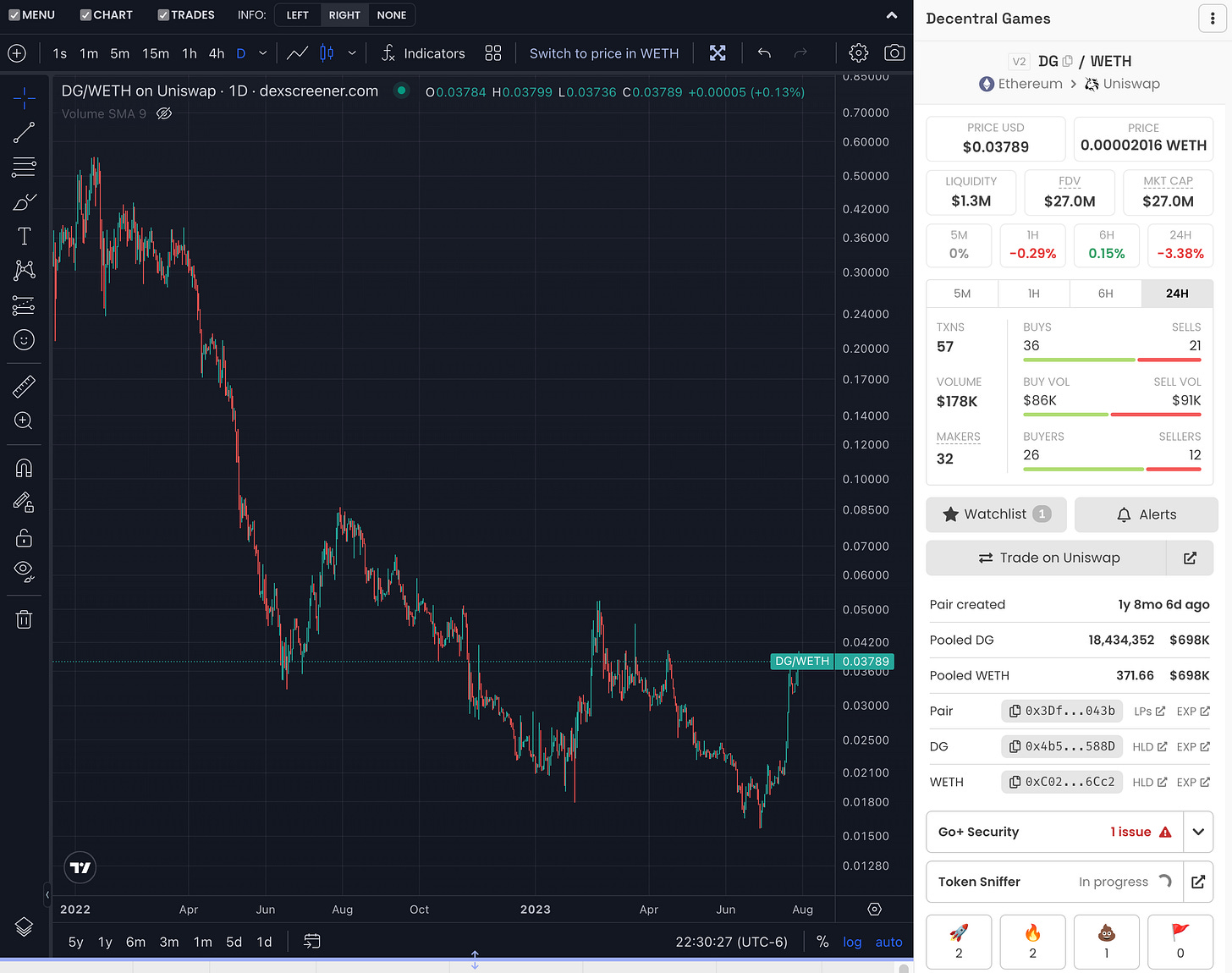

Has been in the development for years, Decentral Games finally rolled out its beta Metaverse Casino on Ethereum last week. To my knowledge, DG stands as the first fully immersive PvP metaverse casino on the mainnet. Current games including cash poker, blackjack and roulette. What stands out to me:

Malta licensed, it’s legit

Games will burn ICE, the in game currency

The treasury is sitting on a sweet $16M, including over $3M in stablecoins, $1M in ETH, and $3.2M in protocol-owned liquidity.

Keep an eye out for coming attractions like deposit bonuses, a referral system, USDT support, and multi-chain support.

Despite the casino narrative heating up (thanks to Rollbit's 6x run last month), DG seems to be flying under CT’s radar. Don't expect the casino narrative to cool down either. Newcomer COCO(also on my list), another casino project that launched on Ethereum a couple of days ago, has already hit ATH mcap of $16M. Meanwhile, DMT, a similar project on Arbitrum, is being valued at over $30M. So, with a fully-diluted valuation of $35M, is DG undervalued? You be the judge.

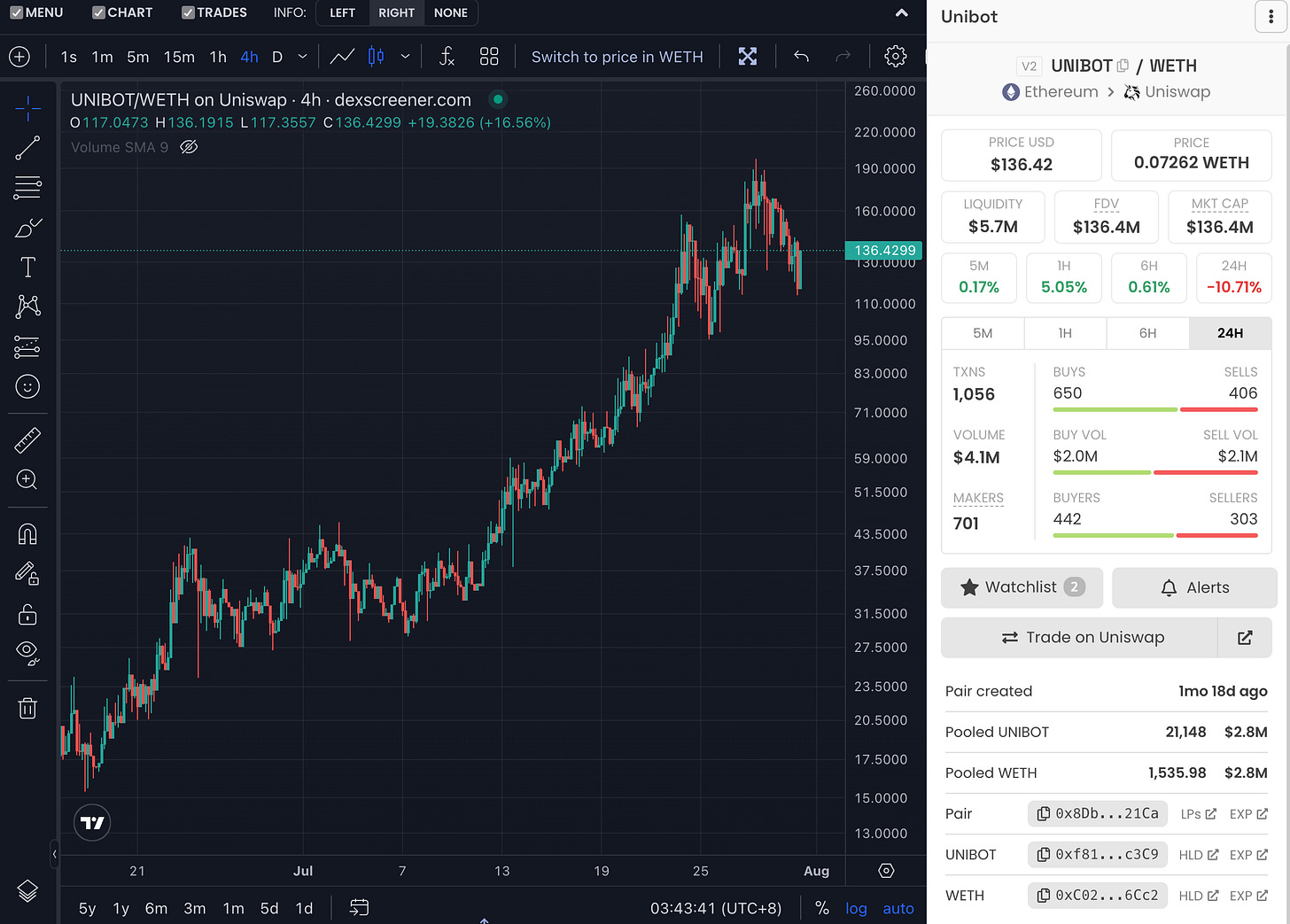

Chart Winter Has Been Watching:

- liquidity sucked by BASE meme coins & bot tokens clearing

- good tax mechanism to eliminate bots and rewarded NFT holders to exit

- NFT mint was 0.35E and current price still gives 2.2e

-expecting chop and potential upside with the TG bot launch (partnered with Pintswap)

THREADS/PODCASTS/INTERVIEWS

Recommendations from rektGEMS:

The chads over at @FlywheelDeFi.eth made a comprehensive list of what we know so far on FRAX v3.

Worldcoin had quite a dramatic debut last week, stirring up a storm of controversy. Hats off to @ercwl for a comprehensive analysis that dives into the technical nitty-gritty and addresses many of the key concerns on people's minds.

Worldcoin has the elements that make it an easy target for skepticism: a sizeable VC-backed wallet, a high fully-diluted valuation at launch, an orb machine wants to “steal“ people’s identities, and a founder named Sam. However, I'm of the belief that the project might be more misunderstood than we think.

Lastly a great piece by our fren Res. I can’t agree with him more on this. Aping coins and price go up require no skills. However, recognizing the ideal moment to take profit in bull market and effectively preserving wealth during the next bear demands knowledge, experience, persistence, consistency, and hard work.