The highly anticipated Arbitrum Short Term Incentive Program has officially kicked off, marking a significant milestone with the initial distribution of 25 million ARB tokens to various projects. A number of these projects have already launched their campaigns. For those looking to get up to speed on the STIP's nuances, here is an insightful post by @stacy_muur.

Arbitrum Autumn? I think so. By now, your twitter bookmark is probably brimming with threads on the Arbitrum STIP. Today, let's pivot our focus to an Arbitrum-native project that hasn't quite captured the spotlight it deserves.

With the ARB staking proposal now greenlit(having passed the snapshot vote and awaiting the Tally vote), I'm convinced we're on the cusp of a pivotal moment for Plutus DAO and plsARB.

Controversies

Before I delve into the reasons behind my bullish stance on PLS and plsARB, it's crucial to address the controversies that have surrounded the Plutus team. For those not yet acquainted with Plutus DAO, it's a governance aggregator native to Arbitrum that currently holds $16M worth of governance tokens from a variety of Arbitrum-based projects. Most notably, it wields 50% of the governance power in Dopex and a significant 9.3% in Arbitrum governance. Plutus DAO allows people to convert their governance tokens to plsAssets(plsAR, plsDPX, etc.) in return for boosted rewards and PLS emissions. The plsDPX has maintained a steady trade, hovering within 15% of its peg for nearly a year post-launch, a testament to its stability. However, the introduction of plsARB brought unforeseen challenges.

During the ARB airdrop, the official frontend was overwhelmed, making ARB claims impossible. Seizing the moment, Plutus provided an alternative frontend, offering users the choice to claim their ARB or convert it into plsARB. The bulk of the 9 million ARB collected by Plutus came in the initial days following the airdrop. The crux of the issue arose when individuals, unfamiliar with Plutus DAO's mechanisms, converted their ARB only to discover that exiting their position in plsARB would result in substantial losses, with plsARB once plummeting to a 65% discount.

Penia's post lays bare the reasons behind the widespread disappointment with Plutus DAO, which can be seen in the governance forum: forum.arbitrum.foundation/t/proposal-activate-arb-staking-final/19068/22

In response, the Plutus team has confronted the issue directly with a comprehensive explanation in their post: forum.arbitrum.foundation/t/proposal-activate-arb-staking-final/19068/26

Having considered the perspectives from both sides, the judgment is now in your hands. IMHO, Plutus team did a terrible job at communication, a challenge that seems all too common among crypto teams nowadays. Yet, is it fair to fault Plutus for the plsARB depegging? That seems questionable. The mechanics of plsARB are consistent with previous plsAssets, what happened to DYOR? In the end, it's pretty straightforward: if the price drops, the team gets flak; if it rises, they're heroes to the same folks.

Now that we've addressed that, let's shift our focus to ARB staking and explore how it could influence Plutus DAO, plsARB, and the PLS token itself.

ARB Staking Proposal

On Monday, a snapshot for 100M ARB tokens to be allocated for ARB staking was approved. You can find the full proposal by the Plutus DAO team here.

TL;DR: The Plutus team is proposing to implement staking mechanism that distributes ARB to token lockers. the proposal suggests that the introduction of ARB staking would reward and encourage the commitment of long-term token holders, laying a crucial foundation for the development of future token utility initiatives. The initial snapshot vote has sanctioned the distribution of 100 million ARB tokens from the Arbitrum DAO treasury, equating to 1% of the total supply, to token lockers over the span of 12 months.

The proposal also highlights several reasons why the activation of ARB staking could have a positive effect throughout the wider Arbitrum ecosystem.

Significantly increase interest in Arbitrum and the ARB token

Allow for composability around an ARB token that can earn yield

Reward long-term aligned stakers with yield while penalizing mercenary capital and short-term actors

Positively differentiate ARB from any other L2 tokens and bring the spotlight back to Arbitrum

Offer a first step and infrastructure towards introducing different forms of revenue sharing in the future

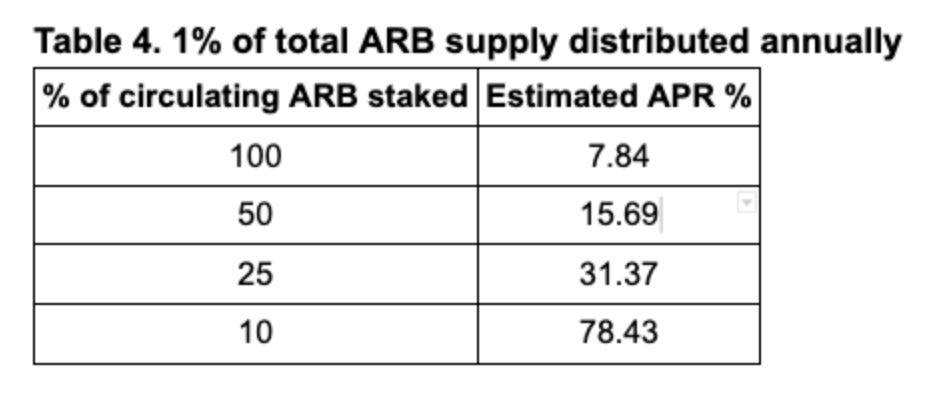

Okay let's dive into the figures. With 100M ARB rewards, assuming that 25% of the circulating ARB is staked, stakers could be looking at an APR of 31.37%. That's a pretty sweet deal, especially when you stack it up against the modest 3-4% APR you'd get from staking ETH and stETH.

But hold on, those APR estimates might not tell the whole story. By the end of 2024, the ARB circulating supply is expected to nearly triple, thanks to team, advisor, and investor token unlocks. Take a peek at the chart below for the estimated APR come June and December 2024.

These APRs are still pretty impressive. Just for context, ETH staking is hovering around 3% APR, BNB between 2-2.5%, and MATIC is at about 4.8% APR. For the long-term holder, these yields are quite the draw, likely nudging them to lock up their ARB. By the end of 2024, if 25% of ARB's circulating supply is staked at an estimated 12% APR, we'd see around 890 million ARB tied up. This commitment would more than make up for the 100 million ARB rewards dished out from the DAO treasury and could even help curb inflation for the following year.

Keep in mind, starting March next year, the team, investors, and advisors will begin to receive their allocations. The option to stake could be a more appealing route for them rather than selling off.

Sure, ARB staking has its pros and cons, but overall, I'm leaning towards it being a win for the ecosystem.

I share all these research first in my FriendTech key holders exclusive group chat, get access by purchasing my FT key HERE. Support me by trading on chain derivatives on Hyperliquid HERE and earn AIRDROP!

plsARB Peg

Why ARB staking has anything to do with Plutus you ask? First we need to understand the mechanism of ARB staking:

The ARB staking contract will allow users to lock their ARB for up to 365 calendar days. A user’s weight is proportional to their lock time.

Users may exit their lock for a penalty between 0-60% of their lock amount, linear vs. lock time remaining (365 days remaining would mean a 60% penalty, and 0 days would be a 0% penalty). This penalty is shared between remaining users according to weight.

Plutus' plsARB offers a compelling proposition: users can tap into the maximum locked APR while retaining liquidity. To date, over 9.5 million ARB have been converted into plsARB. With the upcoming launch of ARB staking, Plutus is positioned to lock in ARB immediately, enabling plsARB holders to start reaping maximum yields right out of the gate. Currently, plsARB is trading at a 45% discount, presenting an opportunity for users to achieve the same yield as those max locking ARB for one year, but at nearly half the cost and staying liquid. I anticipate this discount will be swiftly leveled through arbitrage once ARB staking goes live. The stability of a plsAsset's peg is closely tied to the yield it generates; plsDPX stands as a prime example, having maintained its peg for over a year.

Plutus DAO Revenue

Assuming plsARB soon hovers close to its peg, there are a couple of solid reasons to believe that Plutus DAO could become the leading ARB liquid staking protocol.

Firstly, they have the first-mover advantage. With 9.5 million ARB already on hand, Plutus can swiftly capitalize on staking as soon as it's available. Competitors will have to catch up, likely needing to use their own token emissions to attract ARB.

Secondly, Plutus DAO has built strong partnerships within the Arbitrum ecosystem, collaborating with established projects like Dopex, Jones DAO, GMX, Radiant among others, and integrating plsARB into platforms such as Camelot and Timeswap. A partnership with Rodeo Finance may also be on the horizon. Plutus DAO is well-positioned to build plsARB even further into the Arbitrum eco, creating more yield opportunities which means more demand for plsARB.

Below, you'll find a chart that maps out the potential revenue from plsARB, with the ARB token price and plsARB market dominance as key factors.

This estimate assumes Plutus will levy a 12% fee on ARB staking yields, consistent with fees for other plsAssets. If plsARB reaches a market position comparable to Lido's stETH, and with ARB priced at $2, Plutus DAO could generate $7.2 million in revenue from plsARB alone next year. Given PLS's current circulating market cap of $3.4 million, it appears significantly undervalued.

PLS Tokenomics V2

Let’s take a close look on PLS tokenomics. Back in July, PLS received a complete tokenomics revamp, the new design introduced four new elements: bPLS, vlPLS(votelocked PLS), esPLS(escrowed PLS) and mpPLS(multiplier points). Users can votelock their PLS or PLS-WETH LP for the duration of 16 weeks and receive mpPLS and esPLS which can then be either linear vested in 12 months or staked for more esPLS and mpPLS. A user’s bPLS balance is a function of vlPLS, vlPLS-WETH, staked mpPLS and staked esPLS. Keep staking esPLS and compounding esPLS and mpPLS rewards will increase users’ bPLS balance exponentially. Soon bPLS holders will receive protocol fees(revenue share), bribes, voting power, fee discounts and boosting capabilities within the ecosystem.

PLS v2 tokenomics have been crafted by drawing lessons from leading DeFi models, incorporating elements from Convex's vlCVX and GMX's multiplier points system to benefit long-term holders. This approach has proven effective, with over 64% of PLS supply currently locked.

When ARB staking becomes active, vlPLS holders may propose to activate the fee switch. If approved, revenue from plsARB could be distributed to bPLS holders, transforming PLS into a yield-generating asset and potentially increasing its demand.

Other Catalysts

- ARB rewards are imminent. Plutus DAO will distribute 250K ARB token from their DAO airdrop to bPLS holders, this will further incentivize users to lock their PLS.

- Plutus DAO's major partner, Dopex, is rolling out their V2, which will introduce new revenue streams for veDPX holders. As the largest veDPX holder with over 50% governance power, Plutus stands to gain a sustainable revenue source if Dopex V2 is successful.

- New plsAssets for Camelot, the native Arbitrum DEX, plus plsDPXETH for Dopex's ETH derivative token, and vaults tailored for Radiant's market assets. This diversification promises an uptick in revenue streams. While Plutus may sit out the STIP, the success of these initiatives is poised to significantly boost PLS's value.

- Plutus DAO is also well funded and has a healthy runway. Its treasury containing $2.1 million in assets and an additional $480,000 in yield-generating assets. And of course PLS token are excluded.

PLS Treasury ($2.1M): debank.com/profile/0xbbe98d590d7eb99f4a236587f2441826396053d3

Productive Treasury ($480K): debank.com/profile/0x2e9ee89099ee816eacb7301bcdb57a6375a1c6e1

ARB wallet (9.54M ARB): debank.com/profile/0x180bb71666c4de074b4daa17ed579afcb8eb2c25

DPX wallet:

debank.com/profile/0x6de5bec59ed2575a799f2ac0a0aeaaaf59e61c3d

Bear Cases

If you've followed my other researches, you know I don't shy away from talking about potential risks and the 'what-ifs.' So, let's consider a couple of ways Plutus might not live up to the hype we've discussed.

First, there's the trust issue. Plutus needs to win back user confidence, especially since some early plsARB converters have been itching to cash out, waiting for the price to recover.

Then, there's the competition. New players could swoop in and chip away at Plutus's market share.

And of course, execution is key. Plutus simply has to deliver on its promises.

Sure, these scenarios could unfold, but here's my take: Newcomers might jump at the chance to grab plsARB for the max rewards without the lock-up, nudging it back to a 1:1 peg with ARB. For the second point, Plutus is 9.5M ARB tokens ahead of other teams. Tt'll take a hefty amount of resources and savvy marketing to catch up. For 3, although communication could be much better, I do believe the FUD earlier was largely overblown. I'm keeping an eye on how things progress and am ready to pivot my stance if needed.

Closing Thoughts

Activating ARB staking and fund it with 100M ARB rewards could be an even bigger catalyst and narrative for Arbitrum eco than STIP. Plutus DAO seems poised to come out as the biggest winner. The plsARB product along is set to rake in estimated $3.6M to over $10M next year. Coupled with its sustainable tokenomics model and potential revenue share, I believe PLS is extremely undervalued.

Useful Links

Plutus Overview: https://dune.com/sigrlami/plutusdao-overview

PLS V2 & bPLS Statistics: https://dune.com/sigrlami/plutusdao-v2-overview